US Tax: 2021 Tax Deadlines and Extensions for American Expats.

Minimum income thresholds for US tax filing for expats For 2020 tax year (tax filing in 2021), the minimum income thresholds for US Expats are $12,400 for individuals, $24,800 for married couples (filing jointly), or just $400 of self-employment income for anyone, or...

$900 billion Covid relief deal is announced

US Congressional leaders announced yesterday evening (Sunday 20th December 2020) that they have secured a deal for a $900 billion 'rescue package' to deliver much-needed relief for small businesses, unemployed Americans and health care workers while bolstering vaccine...

US Tax: ABLE Accounts – Final Regulations

ABLE (Achieving a Better Life Experience) accounts are for eligible individuals with a disability – they are tax-favoured savings accounts to which contributions can be made to help pay for qualified disability expenses. The IRS recently released final regulations...

Rachel Finch becomes Certifying Acceptance Agent

We are delighted that Rachel Finch has now officially become a Certifying Acceptance Agent. This means that Rachel can now certify and complete a Certificate of Accuracy (COA) to authenticate foreign identity documents for you, so you don't need to send your identity...

Section 139: Qualified Disaster Payments

At this point, most people have heard about relief measures the government has enacted in the wake of Covid-19, but there remains one opportunity to harvest that has had little discussion surrounding it—Section 139 Qualified Disaster Payments. Background ...

Streamlined Procedure – The IRS Amnesty Program.

The penalty free program for overseas Americans delinquent on their tax returns. The Streamlined Procedure is an IRS amnesty program that allows expats who are non-willfully behind with their US tax filing to catch up without facing any penalties. If you have not...

Real Estate Enterprise: How to Qualify for a Section 199a Deduction

At the end of 2019, the IRS issued updated guidance on a new rental real estate safe harbour rule which allows certain rental real estate to be considered an “enterprise” eligible for a Section 199a deduction. What is Section 199a deduction? Section 199a gives...

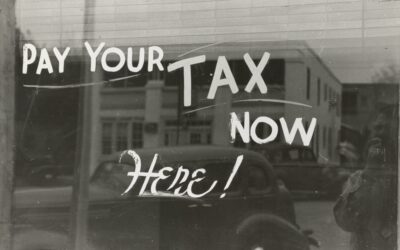

Installment Agreements: What Should You Do If You Can’t Pay Your Taxes

If you can’t pay your taxes, don’t panic. Here’s what to do first: Make sure to file your tax return on time—failure to file is a much higher penalty than failure to pay. Pay as much as possible when you file your tax return, as every dollar you pay at tax time...

Inherited IRAs and the SECURE Act of 2019

At the end of 2019, the SECURE Act (Setting Every Community Up for Retirement Enhancement Act) was signed into law, modifying required minimum distribution (RMD) rules for inherited IRAs and retirement accounts. Under the SECURE Act, inherited IRAs and...

US TAX: Paycheck Protection Loan Forgiveness

When the CARES Act was signed into law, it created the Paycheck Protection Program (PPP), which is a new loan designed to help small businesses pay employee wages and other critical expenses. Proceeds from this loan can be forgiven if certain criteria are met....